Unfortunately, it depends on the situation and reasons, so there is no simple answer for bad credit. A few potential reasons could be that you have experienced a divorce which led to a bankruptcy, mismanaged your finances, experienced job loss, or any other financial hazards.

Your credit is calculated from many moving parts. The good news is that your credit score is constantly changing! If you take steps to improve your financial habits, you may also gain an improved credit score in addition to greater peace of mind.

At Benchmark, we don’t leave you to figure it out all on your own.

You are working hard for the chance to buy your dream home. Shouldn’t your lender ,at least, work just as hard?

Knowing what improvements to make when improving your credit can be tricky. That’s where we can help. For example, while some factors apply to everyone, there will be others that only apply to you.

Some strategies you could use to positively impact your score very quickly are:

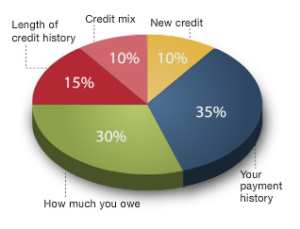

- Keep credit card balances low: I like to call this the rule of 30. Your balance accounts for 30% of your credit score. You want to make sure that your utilization ratio is less than 30%. For example, if you have a credit limit of $1,000, your balance should NEVER exceed $300. If you are already over that, pay it down to where it is less than 30%. By far, this is the mistake that most people make.

- Pay your debts: This is not always as simple as it seems, but this accounts for 35% of your score. Something to keep in mind is that paying off new debt has a greater impact than paying off old debt. If you have a newer open credit card, pay that balance first.

- Clear up any mistakes: Did you know that as many as 4 out of 5 people have errors on their credit reports*? The odds that you may be one of them are high at 80%. While you can pull your own credit for free once a year, credit reports can be difficult to read. At Benchmark, we review your credit report with you to ensure your credit’s accuracy. If errors are found on your report, you have the opportunity to correct them.

*https://www.cbsnews.com/news/4-in-5-credit-reports-have-errors/

Ratio of used credit and payment of debt combine to account for 65% of your score. The next biggest factor is time, or the length of your credit history. If you are trying to improve your credit, it is important that you do not close your credit card accounts. This hits you on two categories: one is your credit utilization ratio ,or how much you owe, because the ratios will not be calculated properly on closed accounts (you’d have debt, but no extra credit limit), and the other is on length of credit history, because a closed account does not report a length of time.

Overall, there is no single quick technique to improve your credit score. It’s best to simply live within your means, by not spending more than your income. If you’d like more information, give us a call. We can help you get a more personalized view of your credit, and help you decide what you can do to improve it.

At Benchmark, we are ready to help you achieve your dream of owning your own home. Call 1-800-VET-EASYus or Contact Us, or get your Certificate of Eligibility to get started today!

The post Can I Still Get A VA Loan With Bad Credit? appeared first on Benchmark.